The UK beer scene is full of creativity, and innovation, yet most pubs pour the same global brands. From the depths of the cellars lies a broken system - one that blocks local breweries, restricts pub tenants with local communities being deprived of flavour and variety.

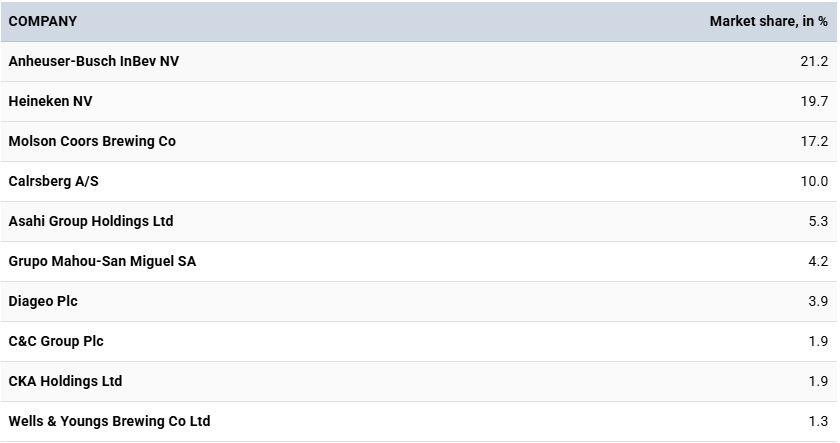

You can walk into most pubs across the UK and chances are you'll see familiar beers like Fosters, Stella, Peroni, and Beavertown Neck Oil being showcased on a gleaming stainless steel T-bar, all owned by at least one of the five global brands that collectively make up over 70% of all beer sales in the UK. Look beyond the lit up beer badges and you'll find a more shocking statistic that, despite there being over 1600 independently owned breweries here in the UK, they only make up around 10% of beer sales.

This isn't down to lack of quality or demand. Independent breweries are the innovators of new styles and flavours. This is about access to market and the iron grip of the beer tie system.

The system that keeps the big brands on top

Beer ties are a legal contract between a pub landlord, breweries and/or pub companies, locking tenants into purchasing products from a restricted list of suppliers exclusively from that pub company or owner. In return the tenant may receive cheaper rent, and/or other support such as free maintenance, or a gleaming new bar/cellar. This not only becomes a barrier for indie breweries but also limits the pub landlord from being able to offer any sort of variety in their pubs.

The Pubs Code etc. Regulations 2016 was put in place to stop global companies from charging tenants above market price for tied products. What it didn't do was remove the ‘tie’ completely and tenants are still only allowed to buy from selected suppliers.

Heineken, AB InBev, Molson Coors, Asahi, and Carlsberg Marston’s dominate the taps across the UK. Their control extends not just through branding and distribution, but through ownership of pub estates and exclusive supply contracts. Accounting for over 70% of beer sales in the UK.

“Some of the big breweries just tying those lines up with offers that are too good to refuse. If you're running a pub and a global brewer offers to come in and fit your cellar out for free and ties you into buying their beer, we can't compete with that.” Says Andy Parker (Elusive Brewing, Wokingham).

The Society of Independent Brewers and Associates (SIBA) reported that on average 60% of pubs within 40 miles of an independent brewery were inaccessible to them, blocking small brewery sales and reducing consumer choice.

Regulations in America

In the U.S, there are heavy regulations put in place to stop any one brewer/company from having too much control over the beer market and persuading tenants with exclusive deals. Operating under a three-tier system it legally separates producers, distributors, and retailers to prevent monopolistic control. In the UK, the system is outdated. It needs a trip to the BBC’s Repair Shop to give more local variety, create community in the local area, give small brewers more access in their local pubs, but most importantly to stop the dominance of global companies having the majority of the market.

I spoke to Jonny Garrett and he had this to say about access to market and tying lines;

Listen to the full chat with Jonny

The economic toll of market inequality

Abolishing beer ties in the UK isn't just about freedom of choice, or supporting independent breweries. It's about the economy too.

Independent breweries employ thousands of people, normally in smaller towns where work is sort after. They contribute to local supply chains, reinvest into their local communities, and to the UK economy.

"An independent brewery opening in an area actually raises house prices. It delivers to the local economy." Says Neil Walker of SIBA.

If market access for indie breweries improved, even modest gains in sales share could inject millions into the UK’s local economies.

A sector under pressure

Nearly 300 pubs closed across England and Wales in 2024 – an equivalent of six a week according to latest figures from the British Beer and Pub Association (BBPA). This was down to many different factors including rising operational costs, alcohol duty increases, and changing consumer habits.

These overlapping factors are pushing many pubs to the brink—but beer ties often act as the final blow, limiting flexibility at a time when it’s most needed.

Ash Corbett-Collins, CAMRA Chairman said:

“Pub companies, and global brewers that own pubs, are imposing highly restrictive ties on their tenants, preventing the communities they serve from genuine choice of local and independent beers at the bar. While CAMRA does recognise that a brewer should be able to expect a pub that they own to stock their beer, what we see today goes far beyond what is fair for tenants, with consumers then denied a real choice at their local.”

“I hope the Government’s ongoing Access to Market Review brings significant changes for our independent producers, consumers and licensees. Without it, we could see global giants slowly wipe out great quality local drinks.”

What if the scales tipped?

Imagine if independent breweries had access to just 25% of the UK’s beer market.

We’d see a cultural renaissance in beer diversity, innovation, and regional styles. Local economies would benefit too. Consumers would enjoy fresher, more unique pints. And pubs would become the central hub of local communities once again, instead of outlets for global corporations.

Groups like SIBA and CAMRA continue to campaign for reform, calling for fairer market access, tax breaks for pubs and small breweries, and changes to alcohol duty. Whether change comes through regulation or consumer pressure, one thing is clear -the current system is not built for the next generation of British beer.